Business

US Federal Reserve Faces Divisions Over Interest Rate Cuts

The US Federal Reserve (Fed) is currently navigating one of its most contentious policy periods in recent history. The recent decision to cut interest rates by 25 basis points in October 2023 marked a significant moment, not just for its numerical value, but for the evident lack of consensus among policymakers. Kansas City Fed President Jeffrey Schmid opposed the cut entirely, while Governor Stephen Miran advocated for a more substantial reduction of 50 basis points. This unusual mix of dissenting views reflects a growing divide within the Fed regarding the direction of monetary policy, as noted by QNB in their latest economic commentary.

Disagreement on Inflation and Policy Direction

The differing opinions among Fed members indicate increasing disagreement over the inflation outlook and the appropriate pace of monetary easing. While a majority acknowledged that disinflation is underway and that there is increasing slack in the labor market, the level of conviction varies. Some officials consider the current policy stance too restrictive and argue that further rate cuts are necessary to create a neutral or even accommodative environment.

Three main factors support this perspective. Firstly, political pressures are mounting, particularly with President Donald Trump openly advocating for deeper rate cuts. His influence is heightened as he signals preferences for a “dovish” successor to take over the Fed Chairmanship when Jerome Powell‘s term concludes in May 2026. Each Federal Open Market Committee (FOMC) meeting is now under greater scrutiny due to these political dynamics.

Secondly, the uncertainty surrounding inflation has notably decreased compared to the highs experienced following the “Liberation Day” tariffs. Shelter inflation, which had previously contributed to persistent inflationary pressures, has started to moderate, while goods inflation is normalizing as supply chains recover.

Lastly, labor market indicators suggest a significant downturn, despite some month-to-month volatility. Job openings have declined sharply, layoffs are increasing, and private payroll trackers hint at further softening in employment conditions.

Future Rate Cuts and Economic Outlook

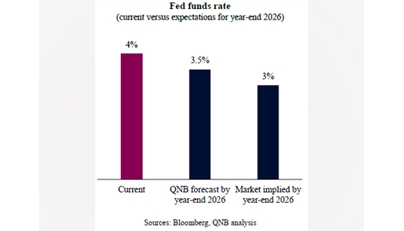

Considering these factors, QNB maintains that there is room for two additional 25 basis points cuts—one likely in December 2023 and another in the first quarter of 2026. This would bring the policy rate closer to the lower end of their neutral estimate of 3.5%.

Nonetheless, expectations for a prolonged series of cuts throughout 2026 may be overly optimistic. While the economy is slowing, it does not show signs of a sharp downturn. There remain uncertainties tied to tariffs and the pace at which inflation can return to the 2% target.

In summary, while the Fed is experiencing notable divisions and an intensifying debate over its future direction, the medium-term path for interest rates is likely to be more measured than what is suggested by the most dovish members or current market projections.

-

World4 months ago

World4 months agoTest Your Knowledge: Take the Herald’s Afternoon Quiz Today

-

Sports4 months ago

Sports4 months agoPM Faces Backlash from Fans During Netball Trophy Ceremony

-

Lifestyle4 months ago

Lifestyle4 months agoDunedin Designers Win Top Award at Hokonui Fashion Event

-

Entertainment4 months ago

Entertainment4 months agoExperience the Excitement of ‘Chief of War’ in Oʻahu

-

Sports4 months ago

Sports4 months agoLiam Lawson Launches New Era for Racing Bulls with Strong Start

-

World5 months ago

World5 months agoCoalition Forms to Preserve Māori Wards in Hawke’s Bay

-

Health4 months ago

Health4 months agoWalking Faster Offers Major Health Benefits for Older Adults

-

Lifestyle4 months ago

Lifestyle4 months agoDisney Fan Reveals Dress Code Tips for Park Visitors

-

Politics4 months ago

Politics4 months agoScots Rally with Humor and Music to Protest Trump’s Visit

-

Top Stories5 months ago

Top Stories5 months agoUK and India Finalize Trade Deal to Boost Economic Ties

-

Health2 months ago

Health2 months agoRadio Host Jay-Jay Feeney’s Partner Secures Visa to Stay in NZ

-

World5 months ago

World5 months agoHuntly Begins Water Pipe Flushing to Resolve Brown Water Issue