World

New Card Surcharge Ban May Force Hawke’s Bay Retailers to Change Payment Options

The New Zealand Government has announced a ban on most card payment surcharges, which could lead some retailers in Hawke’s Bay to reconsider offering contactless payment options such as PayWave. This decision, set to take effect by May 2026, aims to alleviate what officials describe as an “unwelcome surprise” for shoppers when they reach the checkout.

Consumer advocacy group, Consumer NZ, has welcomed the move, calling it a “no-brainer” that will allow consumers to use their cards or mobile devices without incurring additional fees. The government’s initiative is designed to streamline the shopping experience and enhance consumer confidence in digital payment methods.

While the ban on surcharges is intended to benefit consumers, it raises concerns among retail advocates regarding the financial implications for businesses. Retailers still face merchant service fees each time a contactless payment method, such as Visa PayWave or Mastercard, is used. These fees were previously offset by the surcharges that the new legislation aims to eliminate.

Pip Thompson, general manager of Napier City Business, expressed her support for the government’s intention but highlighted the potential financial burden on local businesses. “I understand the desire to remove surcharges, but it’s crucial that we consider how businesses will absorb the costs associated with card transactions,” Thompson stated.

As the ban approaches, retailers in Hawke’s Bay may face tough decisions regarding their payment options. The removal of surcharges could lead to decreased profitability for some establishments if they cannot adjust their pricing strategies. Many retailers may choose to limit or eliminate contactless payment options, which could inconvenience customers who prefer this method of transaction.

The broader implications of the ban extend beyond just Hawke’s Bay. Retailers across New Zealand will need to evaluate their operational costs and pricing structures as they navigate the new landscape. While consumers will benefit from a more straightforward payment process, the government’s decision highlights the delicate balance between consumer protection and the financial viability of small businesses.

In the coming months, it will be essential for both consumers and retailers to adapt to the changing regulatory environment. Retailers may need to explore alternative methods of managing transaction costs, while consumers will likely enjoy a more seamless shopping experience without the additional burden of surcharges.

As the deadline approaches, stakeholders on both sides of the issue will be watching closely to see how the ban on card surcharges will impact the retail landscape in Hawke’s Bay and throughout New Zealand.

-

Lifestyle5 days ago

Lifestyle5 days agoDunedin Designers Win Top Award at Hokonui Fashion Event

-

World5 days ago

World5 days agoTest Your Knowledge: Take the Herald’s Afternoon Quiz Today

-

Sports5 days ago

Sports5 days agoPM Faces Backlash from Fans During Netball Trophy Ceremony

-

World1 week ago

World1 week agoCoalition Forms to Preserve Māori Wards in Hawke’s Bay

-

Top Stories1 week ago

Top Stories1 week agoUK and India Finalize Trade Deal to Boost Economic Ties

-

World1 week ago

World1 week agoFonterra’s Miles Hurrell Discusses Butter Prices with Minister Willis

-

Politics1 week ago

Politics1 week agoPrime Minister Luxon Remains Silent on Foreign Buyers Policy Change

-

World1 week ago

World1 week agoHuntly Begins Water Pipe Flushing to Resolve Brown Water Issue

-

Entertainment1 week ago

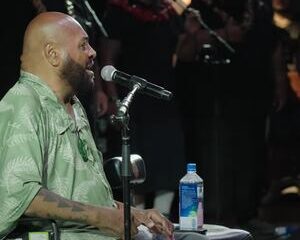

Entertainment1 week agoReggae Icon George ‘Fiji’ Veikoso Passes Away at 55

-

Top Stories1 week ago

Top Stories1 week agoOver 70 Jobs Cut at New Zealand’s Department of Conservation

-

Politics1 week ago

Politics1 week agoEuropean Poultry Showcases Quality at WOFEX 2025 in Manila

-

Top Stories1 week ago

Top Stories1 week agoElectoral Changes Spark Debate on Public Health and Democracy